are my assisted living expenses tax deductible

I read your column that nursing home expenses are tax. Dental costs like dentures fillings and other equipment related to orthodontics.

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

Then add that to the rest of your qualifying medical expenses for the tax year.

. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible. The assisted living facility. Are assisted living facility cost and expenses tax deductible.

Parking fees or travel fees related to a medical need. You can deduct your medical expenses minus 75 of your income. Your medical expense deduction is the sum of all your qualifying medical expenses minus 75 of your adjusted gross income.

In many cases 100 percent of the monthly fee can be considered a medical expense and can be deducted as long as it meets the criteria of being. For taxpayers under the age of 65 medical expenses must exceed. According to the IRS any qualifying medical expenses that make up more than 75 percent of an individuals adjusted gross income can be deducted from taxes.

If this number is. Therapy or other mental health costs. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

Prescription drugs and insulin. What Assisted Living Expenses are Tax Deductible. Tax deductions are the perfect example.

Yes in certain instances nursing home expenses are deductible medical expenses. If the cost goes over 75 which would be 3375 a year for this example then amounts over this number would be deductible. Cannot perform at least two activities of daily living such as eating toileting transferring bath dressing or continence.

If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that. You and your loved one can deduct more than half of your income for medical expenses if they live in an assisted living community.

The amount that you can deduct for tax purposes will differ depending on your particular situation. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A. It must be possible to bring additional medical expenses over 7 per cent of your income.

Assisted Living communities and tax advisors are aware of these deductions and can provide specific information to help you or a loved one. If that individual is in a home primarily for non-medical reasons then. Some Assisted Living patients will be able to deduct the entire monthly rental fee while others may only deduct the medical component of the assisted facility.

Chronic Illness and Tax Deductible Status. This means a doctor or nurse has certified that the resident either. Are assisted living expenses tax deductible in 2021.

For tax purposes individuals with adjusted gross incomes can deduct up to 5. Sometimes the living cost for room and board will not be covered while other times it will be considered part. Medical expenses such as the part of assisted living fees that goes toward assistance and interventions can be deductible if those expenses are greater than 75 percent of the persons adjusted gross income.

To calculate your total medical expense tax deduction start by determining your qualifying assisted living expenses per the above information. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. Are assisted living expenses tax deductible in 2021.

Medical expenses generally make up at least a portion of the monthly service and entrance fees at assisted living communities. But did you know some of those costs may be tax deductible. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia.

The trick is to determine if moms assisted living facility costs qualify as expenses. Tax Deductions for Assisted Living. Keith cpa there are currently more than one million individuals living in assisted living communities in the us.

For those living in assisted living communities part or all of the living expenses may qualify for a medical-expense deduction. For some residents the entire monthly rental fee. For example if your medical expenses are 10000 and your annual income is 100000 you could only deduct 2500 from your taxes.

If you and your spouse are over the age of 65 you can deduct medical expenses that exceed 75 of your adjusted gross income. Which means a doctor or nurse with. What portion of assisted living is tax deductible.

Here are some common expenses related to assisted living that can be easily written off when it comes to tax season. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. Qualified long-term care services have been defined as including the type of daily personal care services provided to Assisted Living residents such as help with bathing dressing continence.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. To deduct any medical expenses you must be eligible to itemize deductions according to Form 1040 Schedule A. To qualify for cost-of-living deductions there must be a plan of care prepared listing all of the services that the resident will receive to qualify for the deduction.

Medical costs such as assisted living that is not provided for by insurance or any other source may be deductible. Itemized expenses must fall into the IRS definition of qualified expenses. The breakdown should also take into account any subsidies that reduce the attendant care expenses unless the subsidy is included in income and is not deductible from income.

75 of your income is 7500 so you could only deduct 2500 10000-7500 from your taxes. The breakdown must clearly show the amounts paid for staff salaries that apply to the attendant care services listed under Salaries and wages Expenses you can claim. For tax returns filed in 2021 taxpayers can deduct qualified unreimbursed medical expenses that are more than 75 of their 2020 adjusted gross incomeSo if your adjusted gross.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

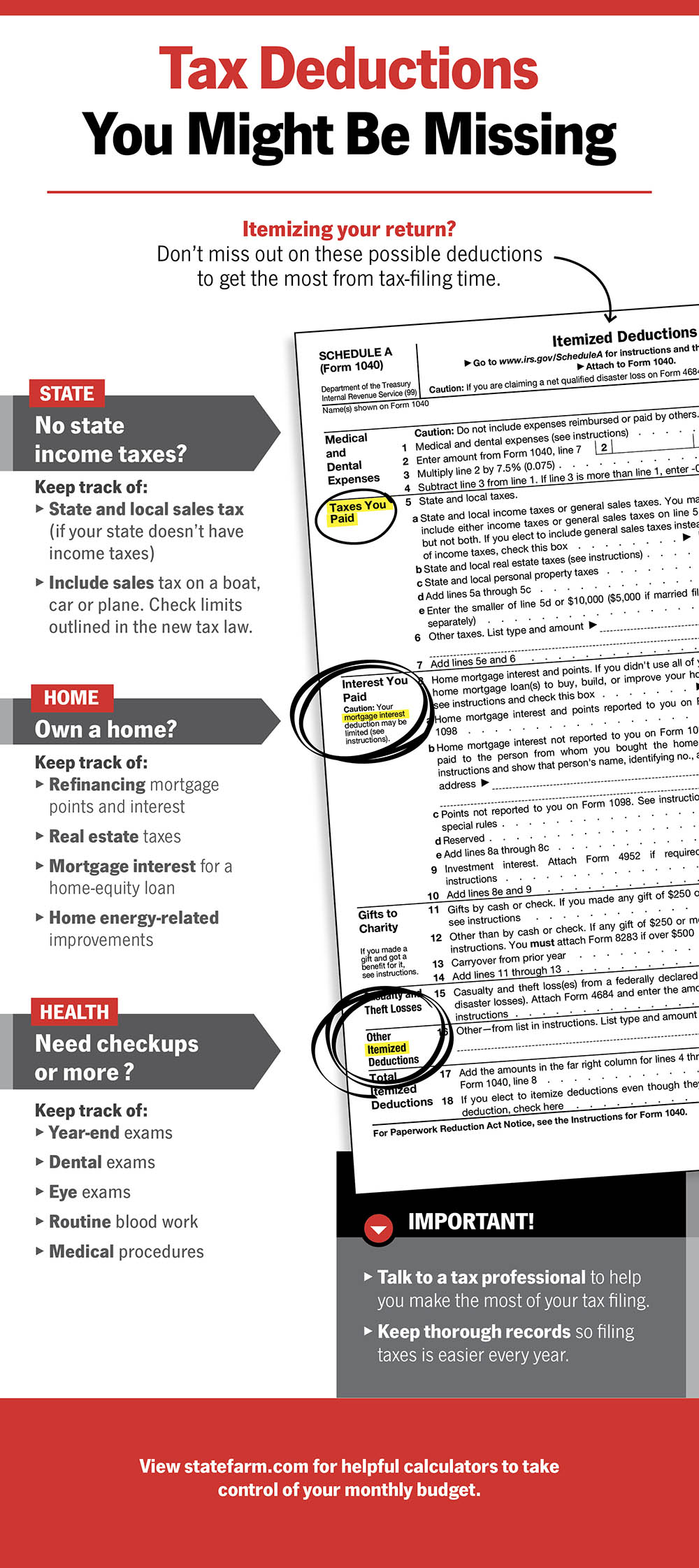

Common Tax Deductions You Might Be Missing

10 Creative But Legal Tax Deductions Howstuffworks

Are Assisted Living Expenses Tax Deductible Andrew J Chamberlain Law Specialist

Tax Deductions For Assisted Living

How To Deduct Your Home Office On Your Taxes Forbes Advisor

What Assisted Living Expenses Are Tax Deductible Boise Id

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Is Assisted Living Tax Deductible Five Star

Tax And Accounting Services Tax Deductions Tax Services Tax Accountant

Are Medical Expenses Tax Deductible Community Tax

What Tax Deductions Are Available For Assisted Living Expenses

Common Health Medical Tax Deductions For Seniors In 2022

Meals Entertainment Deductions For 2021 2022

Are Medical Expenses Tax Deductible

Are Medical Expenses Tax Deductible Community Tax

Is Assisted Living Tax Deductible Medicare Life Health

Common Health Medical Tax Deductions For Seniors In 2022

Can You Claim A Tax Deduction For Assisted Living The Arbors